International Business Machines Corporation on Monday announced it will invest $150 billion in the U.S. over the next five years, including more than $30 billion to advance American manufacturing of its mainframe and quantum computers.

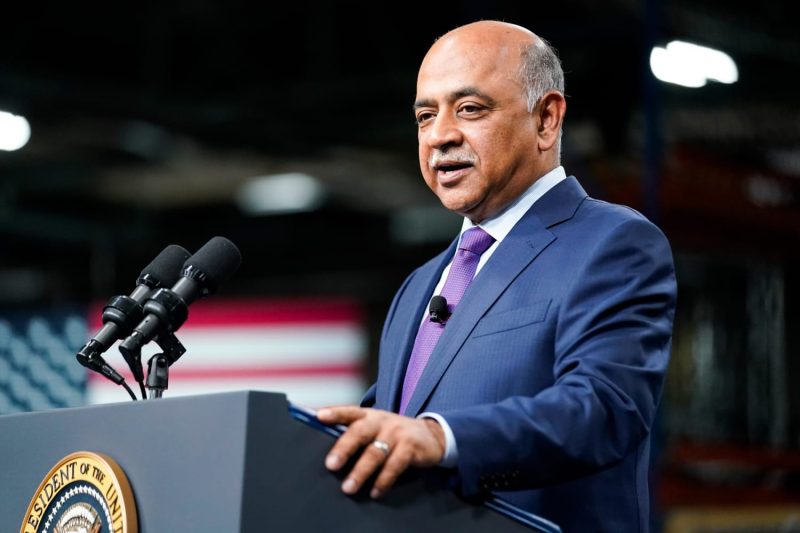

“We have been focused on American jobs and manufacturing since our founding 114 years ago, and with this investment and manufacturing commitment we are ensuring that IBM remains the epicenter of the world’s most advanced computing and AI capabilities,” IBM CEO Arvind Krishna said in a release.

The company’s announcement comes weeks after President Donald Trump unveiled a far-reaching and aggressive “reciprocal” tariff policy to boost manufacturing in the U.S. As of late April, Trump has exempted chips, as well as smartphones, computers, and other tech devices and components, from the tariffs.

IBM said its investment will help accelerate America’s role as a global leader in computing and fuel the economy. The company said it operates the “world’s largest fleet of quantum computer systems,” and will continue to build and assemble them in the U.S., according to the release.

IBM competitor Nvidia, the chipmaker that has been the primary benefactor of the artificial intelligence boom, announced a similar push earlier this month to produce its NVIDIA AI supercomputers entirely in the U.S.

Nvidia plans to produce up to $500 billion of AI infrastructure in the U.S. via its manufacturing partnerships over the next four years.

Last week, IBM reported better-than-expected first-quarter results. The company said it generated $14.54 billion in revenue for the period, above the $14.4 billion expected by analysts. IBM’s net income narrowed to $1.06 billion, or $1.12 per share, from $1.61 billion, or $1.72 per share, in the same quarter a year ago.

IBM’s infrastructure division, which includes mainframe computers, posted $2.89 billion in revenue for the quarter, beating expectations of $2.76 billion.

The company announced a new z17 AI mainframe earlier this month.

CNBC’s Jordan Novet contributed to this report.