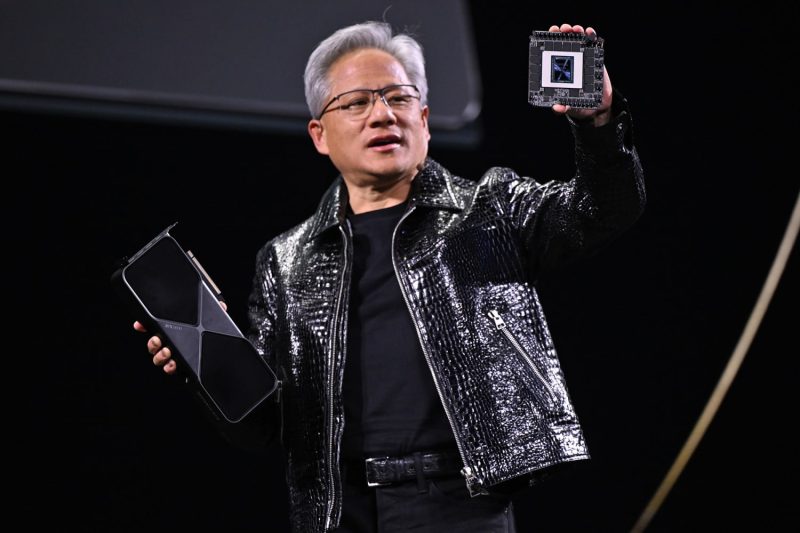

Nvidia CEO Jensen Huang downplayed the negative impact from President Donald Trump’s tariffs, saying there won’t be any significant damage in the short run.

“We’ve got a lot of AI to build … AI is the foundation, the operating system of every industry going forward. … We are enthusiastic about building in America,” Huang said Wednesday in a CNBC “Squawk on the Street” interview. “Partners are working with us to bring manufacturing here. In the near term, the impact of tariffs won’t be meaningful.”

Trump has launched a new trade war by imposing tariffs against Washington’s three biggest trading partners, drawing immediate responses from Mexico, Canada and China. Recently, Trump said he would not change his mind about enacting sweeping “reciprocal tariffs” on other countries that put up trade barriers to U.S. goods. The White House said those tariffs are set to take effect April 2.

“We’re as enthusiastic about building in America as anybody,” Huang said. “We’ve been working with TSMC to get them ready for manufacturing chips here in the United States. We also have great partners like Foxconn and Wistron, who are working with us to bring manufacturing onshore, so long-term manufacturing onshore is going to be something very, very possible to do, and we’ll do it.”

Shares of Nvidia have fallen more than 20% from their record high reached in January. The stock suffered a massive sell-off earlier this year due to concerns sparked by Chinese artificial intelligence lab DeepSeek that companies could potentially get greater performance in AI on far-lower infrastructure costs. Huang has pushed back on that theory, saying DeepSeek popularized reasoning models that will need more chips.

Nvidia, which designs and manufactures graphics processing units that are essential to the AI boom, has been restricted from doing business in China due to export controls that were increased at the end of the Biden administration.

Huang previously said the company’s percentage of revenue in China has fallen by about half due to the export restrictions, adding that there are other competitive pressures in the country, including from Huawei.