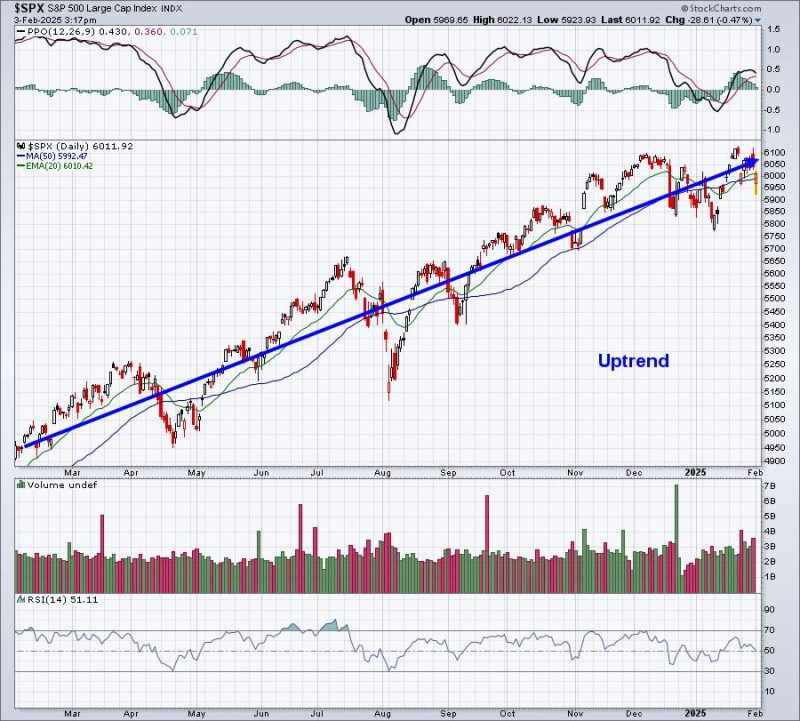

Secondary market signals are beginning to line up for a further drop, which can sometimes provide false signals. The primary indicator for me is always the combination of price/volume. When I only look at price/volume on the S&P 500, it still remains easy to be long – on all time frames:

S&P 500 – daily:

S&P 500 – weekly:

S&P 500 – monthly:

It’s REALLY hard to argue with uptrends and I’m not arguing with whether we’re in an uptrend. But I am beginning to see many secondary signals issuing warning signs that the risk of remaining long no longer makes sense. That’s about where I think we are now. I can’t guarantee lower prices ahead, but I CAN see warning signs. The VIX is one of those. As the S&P 500 rises, the VIX drops. That’s the historical relationship. To me, it’s a warning when the S&P 500 climbs and the VIX does too. That tells us that market nervousness is growing and the S&P 500 will unlikely handle bad news well. Here’s a chart that shows the building fear and nervousness, despite the recent all-time high price:

I don’t like to see fear escalating, like what’s in the bottom panel, when we’re trying to make another all-time high breakout. We should instead be seeing the VIX moving towards the recent low at 13. But here we are with a VIX at 18.22. I’ve previously posted on this blog that the absolute worst market days occur when the VIX is above 20. That’s where we can see severe impulsive selling kick in. We’re teetering here folks and everyone should be on high alert for a possible market meltdown.

YouTube FREE Live Streaming Event Today

If you want to check out MANY secondary warning signals that I’m seeing in the market right now and why you should be preparing to “batten down the hatches”, join me on our EarningsBeats.com YouTube channel for FREE. JOIN ME HERE and we’ll get things started at 5:30pm ET today. Should you be worried about a BIG selloff? Well, I’m nearly always bullish and I’ve moved to 100% cash, if that tells you anything. Watch these warning signs and then decide for yourself.

I hope you’re able to join, it might just save you a bundle!

Happy trading!

Tom