Top 5 Stocks in “Go” Trends

Trend Continuation on Rising Momentum

GoNoGo Charts® highlight low-risk opportunities for trend participation with intuitive icons directly in the price action. The resurgence of momentum in the direction of the underlying price trend is an excellent entry opportunity, or the chance to scale up positions.

GoNoGo Icons® illuminate these events on the chart with green solid circles (or red circle to highlight continuation of NoGo trends). When GoNoGo Trend® is painting blue or aqua bars, a green solid circle will appear below price each time GoNoGo Oscillator® finds support at zero.

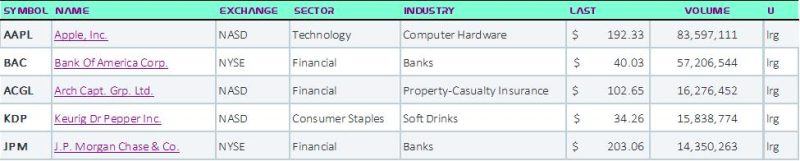

Below are the top 5 stocks/ETFs in “Go” trends with surging momentum by volume in the S&P 500 as of the daily closing price action:

StockCharts Scan for GoNoGo “Go” Trend Continuation

Apple, Inc. (AAPL)

§ GoNoGo Icons signaled a trend continuation on Friday (05/31/24).

§ After a sharp reversal last Friday, price climbed higher finishing the week on strong “Go” conditions painting blue bars back at prior highs.

§ GoNoGo Oscillator found support at the zero line this week, building a small squeeze before rising positive on Thursday and Friday.

§ AAPL has traded on light relative volume for the past three weeks.

Bank of America Corp. (BAC)

§ GoNoGo Trend returned to strong blue “Go” conditions to conclude the trading week just above prior highs at $40/share.

§ After a heavy wide range of trading Thursday, price closed right back up at the open.

§ GoNoGo Icons signaled a trend continuation on Friday (05/31/24).

§ GoNoGo Oscillator ended the week in positive territory finding support at zero.

§ Volume picked up during Friday’s strong rally.

Arch Capt. Grp. Ltd. (ACGL)

§ GoNoGo Trend sustained “Go” conditions, though it softened to weak form aqua bars the second half of the trading week.

§ GoNoGo Icons signaled a trend continuation on Friday (05/31/24).

§ GoNoGo Oscillator ended the week in positive territory after testing the zero line on heavy relative volume.

Keurig Dr Pepper Inc. (KDP)

§ GoNoGo Trend returned to strong blue “Go” conditions to end this trading week.

§ This recovery follows weakening trend conditions and corrective price action.

§ GoNoGo Icons signaled a trend continuation on Friday (05/31/24).

§ GoNoGo Oscillator retested and found support at the zero line for the 4th time in May showing a cluster of continuation icons.

§ GoNoGo Squeeze® built small grids as momentum compressed at the neutral zero line for the 2nd time in the past two trading weeks.

§ Momentum broke to positive territory on Friday – this time rallying on heavy relative volume.

J.P. Morgan Chase & Co. (JPM)

§ GoNoGo Trend ended the trading week on strong blue “Go” conditions.

§ GoNoGo Icons signaled a trend continuation on Friday (05/31/24).

§ GoNoGo Oscillator entered the trading week at the neutral zero line, building a squeeze, before breaking back into positive territory again on Friday.

§ JPM is trading on light relative volume.