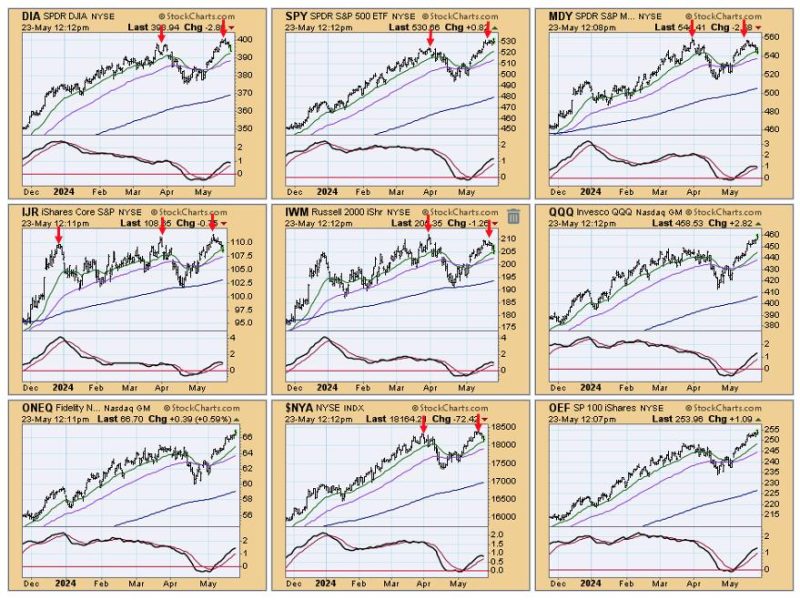

In spite of the massive celebration of Nvidia’s earnings report, we are seeing troublesome signs that the market is in the process of putting in a top. There are double top formations on six of the nine major indexes we follow, but the three indexes that haven’t topped yet, Nasdaq 100, S&P 100, and Nasdaq Composite, have heavy influence from big tech stocks.

We also have double or triple tops on nine of the eleven S&P 500 Sectors. Of the two remaining sectors, only Technology (XLK) hasn’t topped. Consumer Staples (XPL) doesn’t have a double top, but it does appear to have topped–a double is not required.

As we were writing this article, the market made new, all-time highs intraday, but it reversed quite sharply, supposedly because of worry that the Fed won’t cut rates this year. We prefer to think it had more to do with the technical problems (many negative divergences) we see on the chart below.

Conclusion: The superb performance of the technology sector, and Nvidia in particular, has drawn attention away from other areas of the market where the picture is not so stellar. While most of those areas are not yet in a ditch, price action is telling us to prepare for potential problems in the near future.

Learn more about DecisionPoint.com:

Watch the latest episode of the DecisionPointTrading Room on DP’s YouTube channel here!

Try us out for two weeks with a trial subscription!

Use coupon code: DPTRIAL2 at checkout!

Technical Analysis is a windsock, not a crystal ball. –Carl Swenlin

(c) Copyright 2024 DecisionPoint.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.

Helpful DecisionPoint Links:

Price Momentum Oscillator (PMO)