Good morning and welcome to this week’s Flight Path. The equity “NoGo” trend continued this week even with some relief rallies as price attempted to move higher from the recent low. We see GoNoGo Trend painting weaker “NoGo” bars as the week ended. Treasury bond prices remained embroiled in a strong “NoGo” trend with the indicator painting purple bars again this week. GoNoGo Trend showed that the “Go” trend was able to survive in the commodity space, although we do see weakness with paler aqua bars. The dollar, also remained in a “Go” trend, but also painted weaker aqua bars.

Equities New “NoGo” Shows Weakness

The new “NoGo” trend that we spotted in equities last week survived this whole week but we did see weakness as GoNoGo Trend painted several weaker pink bars. This comes as price rallied off the lows. We will now watch the oscillator panel as GoNoGo Oscillator runs up agains the zero line from below. We know that if this “NoGo” trend is to remain healthy, the zero level should provide resistance for the oscillator. If it is turned back into negative territory then we would expect another leg down in price and an attempt at a new lower low.

The larger weekly chart shows that recent price action has been enough to bring out weakness on the chart. We see a third successive pale aqua “Go” bar as price falls from the recent Go Countertrend Correction Icon (red arrow). GoNoGo Oscillator has fallen fast to the zero line and we will now watch to see if it finds support at that level. If it does, then we will know that the “NoGo” trend on the daily will struggle to survive. A break of the zero line into negative territory here though would allow the correction on the daily to last a little longer.

Rates See Continued Strength

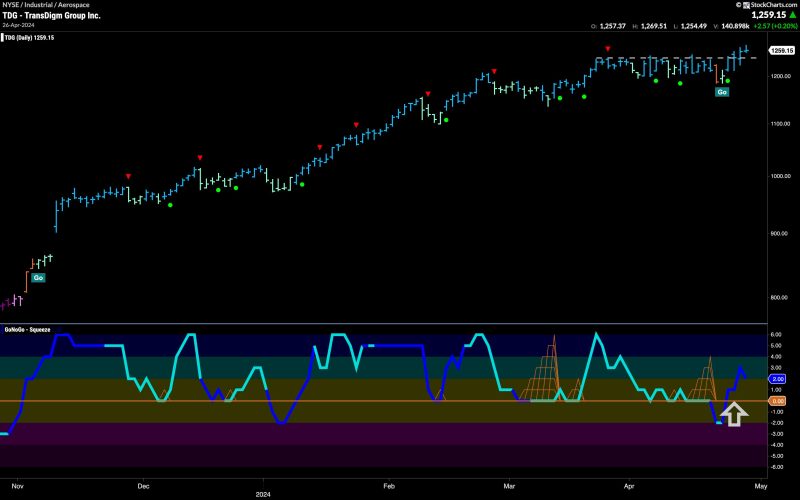

More strong blue “Go” bars this week as price made a new intra week higher high. We look now for price to consolidate at these elevated levels. GoNoGo Oscillator is still in positive territory and no longer overbought. We will watch to see if it approaches the zero line and what happens when it does. Currently, a bullish picture, as GoNoGo Trend paints strong blue “Go” bars and momentum is confirming the trend with GoNoGo Oscillator in positive territory.