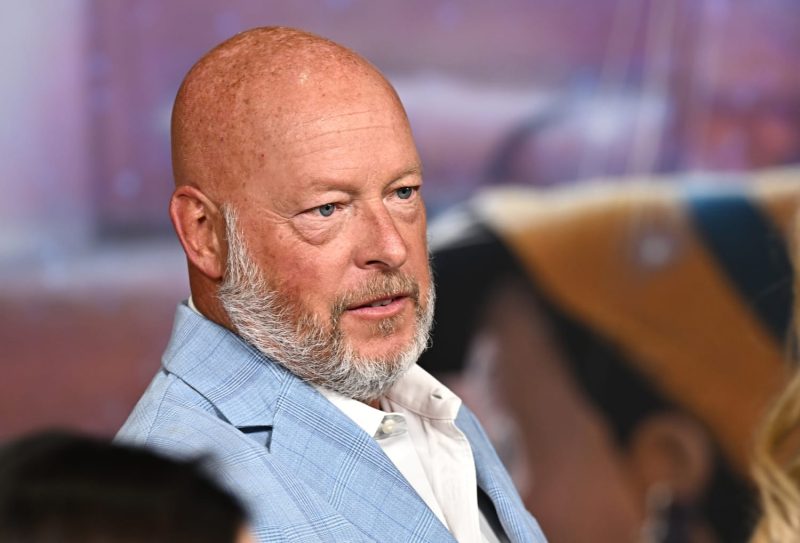

In his first public comments since Disney fired him as CEO in November 2022, Bob Chapek told CNBC he sees no reason for Disney-owned ESPN to add minority partners.

“Strategically, I don’t really see a benefit in bringing on yet another minority partner into ESPN,” Chapek said as part of the CNBC documentary “ESPN’s Fight for Dominance,” which chronicles the network’s digital strategy, published Thursday.

Disney CEO Bob Iger told CNBC’s David Faber in July that he’d consider selling a minority stake in ESPN to strengthen the sports network’s content or technology as it plans a new direct-to-consumer offering, which he later said would launch by fall 2025.

The company hasn’t yet announced a deal to sell a stake in ESPN. CNBC reported in August that the network had held talks with the major American professional sports leagues, including the National Football League and the National Basketball Association, about potential partnerships or investments.

Disney owns 80% of ESPN and Hearst owns the other 20%, a structure that’s been in place since 1996. By searching for a partner, Disney wants to enhance the content, distribution and marketing of the direct-to-consumer ESPN, which hasn’t yet been priced, Iger said during Disney’s August quarterly earnings call.

Striking a partnership with one of the professional sports leagues could help secure future live rights, though it may irritate other media companies that bid against Disney for packages of games. Bringing on a technology or telecommunications company such as Verizon or Apple could give ESPN broader distribution options by reaching larger customer bases.

Still, it’s unclear selling equity in ESPN is needed to strike an arrangement. ESPN President Jimmy Pitaro, who also spoke with CNBC as part of the documentary, downplayed the need for the sports network to sell a stake in its business to build a partnership with a league or another company.

“It’s not about equity,” Pitaro said. “It’s not about these partners taking an ownership interest in ESPN. That is something, as Bob [Iger] has said, that we are very much open to, but this is about partnership and accelerating the launch or the adoption of ESPN flagship.”