(This is an excerpt from the subscriber-only DecisionPoint Alert on DecisionPoint.com)

This week, the markets experienced a dramatic bias shift. We measure the Intermediate-Term Bias using our Silver Cross Index (SCI). The SCI measures how many stocks within an index, sector, or industry group hold “silver crosses”, as in a 20-day EMA above the 50-day EMA.

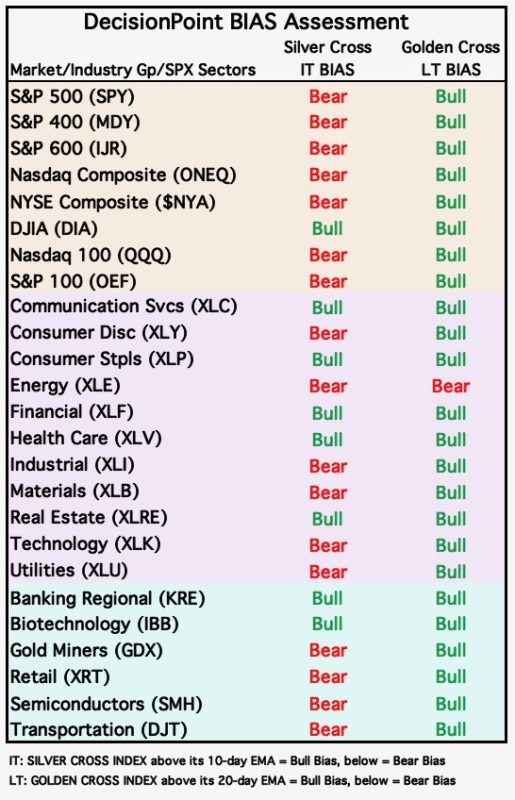

When the SCI moves below its signal line, it shifts the Bias to BEARISH. This week, we saw every major market index we follow, with the exception of the Dow Industrials, move to Bearish Biases. We’ve also seen similar activity among the sectors and industry groups we follow.

To reiterate, the bias shift is due to a Silver Cross Index crossing down through its 10-day EMA, which means that some stocks within the given market index are experiencing 20/50-day EMA downside crossovers. When the 20-day EMA is below its 50-day EMA, the stock is, at the very least, in correction mode. The chart below is one that we use daily to track bias shifts. Clearly, most indexes still have a high percentage of stocks that still have a Silver Cross, but their bias is now bearish because of the shift below the moving average.

Conclusion: Based on the Silver Cross Indexes moving below their EMAs, we have new Bearish Biases on nearly every market index we follow. These Bear Shifts often precede longer declines. The weakness within these indexes implies a more concerted decline to follow.

Be sure to take advantage of our free trial if you want to know the Bias in all three timeframes daily. As a subscriber, you also have access to our exclusive ChartLists. Just use coupon code: DPTRIAL2 at checkout.

Learn more about DecisionPoint.com:

Try us out for two weeks with a trial subscription!

Use coupon code: DPTRIAL2 at checkout!

Technical Analysis is a windsock, not a crystal ball. –Carl Swenlin

(c) Copyright 2024 DecisionPoint.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)