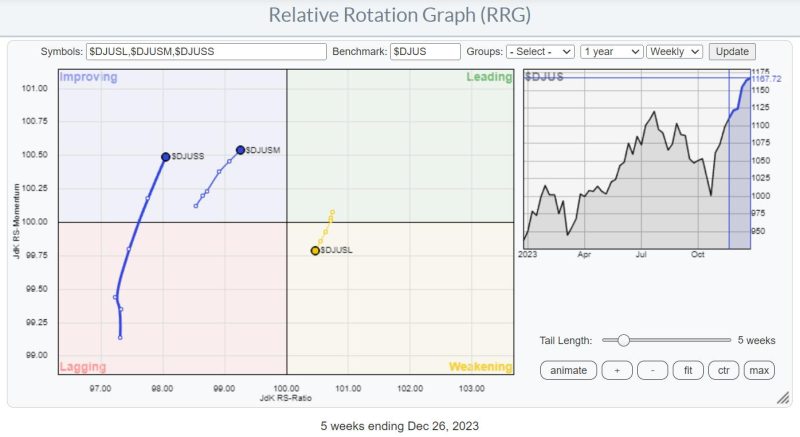

I have used this Relative Rotation Graph regularly in the past few weeks to indicate the ongoing rotation out of large-cap stocks into the mid-and small-cap segments.

This is happening while the market as a whole, in this case, the Dow Jones US index ($DJUS), continued to move higher.

What this means is that investors are pulling money out of large-cap stocks and re-distributing it to the mid- and small-cap segments. While also adding fresh money into the market (otherwise, we would not be going higher).

In this last written RRG article for this year, I’d like to review a Relative Rotation Graph that I introduced in Sector Spotlight a few weeks ago.

Sector Spotlight 11/7/23

This particular RRG uses ratio symbols to visualize the difference in rotation between cap-weighted and equal-weighted sectors.

You may need a few seconds to adjust and understand what we are looking at here.

The 11 tails each represent the comparison between the cap-weighted sector divided by the equal-weight sector. So for technology, that is XLK:RSPT.

When that ratio moves higher, cw is outperforming ew and vice versa. So, we are interested in the absolute direction of that tail. Therefore, we use $ONE as the benchmark.

*When you are a StockCharts.com subscriber, clicking on the image will take you to this RRG, which you can then save as a bookmark in your browser for later retrieval

Now, look at that RRG again.

What immediately stands out, at least to me and I hope to you as well, is the large group of tails inside the weakening quadrant and heading towards lagging. We can include XLI:RSPN in that group as well, as it is close to crossing into weakening and also traveling at a negative heading. XLF:RSPF is already well inside the lagging quadrant and heading deeper into it at a negative heading.

For all these sectors :

FinancialsIndustrialsMaterialsTechnologyConsumer StaplesConsumer DiscretionaryHealth CareCommunication Services

the conclusion is that the equal-weight versions should be preferred over their cap-weighted counterparts.

That leaves only three sectors where the cap-weighted version has a better outlook for the coming weeks. These are

Real-Estate inside the leading quadrantUtilities inside the improving quadrantEnergy moving back from lagging to improving

It is a clear rotation away from cap-weighted, i.e., large-cap names, to the second and maybe third-tier market capitalizations at the start of the new year.

I am going to leave you to think about this observation. I wish you a very happy New Year, and I am looking forward to seeing you back in 2024 with more written RRG blog articles and Sector Spotlight videos.

Thank you for 2023, –Julius.