For last year’s Outlook, I wrote:

Perhaps our biggest callout for a major rally in 2023 is in gold.

Here we are over $2000 and, although gold has not doubled in price, it did rise by 25%.

For 2024, we stay with our call for higher gold prices. I am looking for a move to $2400, provided gold continues to hold $1980.

That statement was from December 1st.To add to that statement:

Trends for 2024 — Gold and Silver start their Last Hurrah

Here are some updated thoughts to add to the great content of the Outlook (which we highly recommend you get your free copy of):

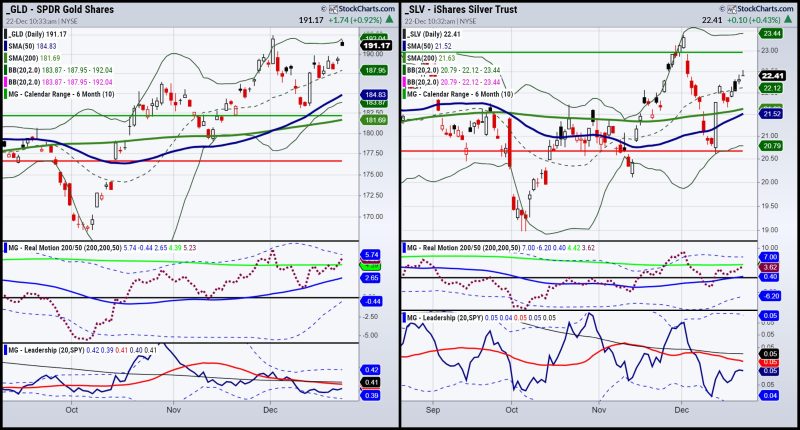

The look of the daily charts in both gold and silver show even more potential in silver for the coming year. Gold has hit resistance and remains an underperformer to SPY. It still sits at the highs like a quiet blanket of safety.

Silver has yet to hit resistance. If it can take out 23.40, we see no reason why 27-30 is not attainable.

Regardless, have a look at the Outlook to understand more fully why these metals need to be a part of your investing plan.

Click this link to get your free copy of the Outlook 2024 and stay in the loop!

This is for educational purposes only. Trading comes with risk.

If you find it difficult to execute the MarketGauge strategies or would like to explore how we can do it for you, please email Ben Scheibe at Benny@MGAMLLC.com, our Head of Institutional Sales. Cell: 612-518-2482.

For more detailed trading information about our blended models, tools and trader education courses, contact Rob Quinn, our Chief Strategy Consultant, to learn more.

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth.

Grow your wealth today and plant your money tree!

“I grew my money tree and so can you!” – Mish Schneider

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Mish in the Media

Mish discusses gold, silver and why self care and “all about me” can trend in 2024 in this video from Yahoo! Finance.

Coming Up:

December 27: Wrap up extended session, Benzinga

December 28: Singapore Breakfast Radio

January 2: The Final Bar with David Keller, StockCharts TV

January 5: Daily Briefing, Real Vision

Weekly: Business First AM, CMC Markets

ETF Summary

S&P 500 (SPY): 480 all-time highs, 465 underlying support.Russell 2000 (IWM): 200 pivotal and 194 support.Dow (DIA): Needs to hold 370.Nasdaq (QQQ): 410 resistance with support at 395.Regional Banks (KRE): 47 support, 55 resistance.Semiconductors (SMH): 174 pivotal support to hold this month.Transportation (IYT): Needs to hold 250.Biotechnology (IBB): 130 pivotal support.Retail (XRT): The longer this stays over 70.00 the better!

Mish Schneider

MarketGauge.com

Director of Trading Research and Education