SPX Monitoring Purposes; Long SPX 10/27/23 at 4117.37.

Gain Since 12/20/22: Over 26%.

Monitoring Purposes GOLD: Long GDX on 10/9/20 at 40.78.

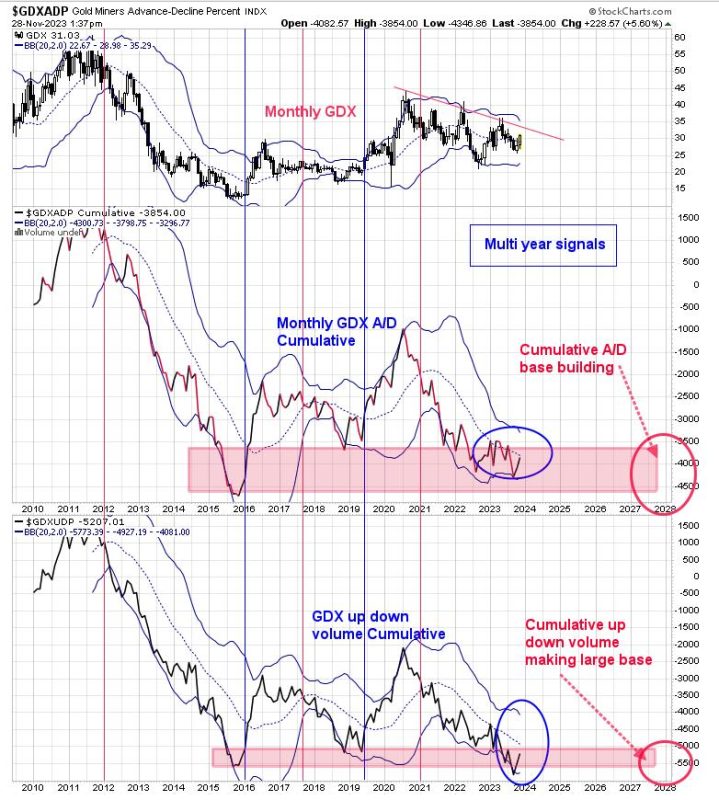

There is a very good likelihood of a multi-year signal triggering for GDX in the coming months.

The above chart is on the monthly time frame. The bottom window is the GDX Cumulative Up Down Volume percent, and the next higher window is the GDX Cumulative Advance/Decline percent. These signals generate after a bottom is in, but, once they are triggered, the signal can last many months or years. Bullish signals are generated when both indicators close above mid-Bollinger bands (noted with blue lines) and bearish signals when both indicators close below mid-Bollinger bands (noted with red lines).

Both monthly indicators reached near the 2016 low (noted with pink shaded areas), noting an oversold market. The last sell signal came in early 2021 (nearly 3 years ago), and is now nearing a bullish crossover of the mid-Bollinger band, which may take another month of two. We do have evidence that a worthwhile low has formed already and a bullish mid-Bollinger band crossing of both indicators above will signal that a multi-month, if not a multi year, rally is coming.

Tim Ord,

Editor

www.ord-oracle.com. Book release “The Secret Science of Price and Volume” by Timothy Ord, buy at www.Amazon.com.

Signals are provided as general information only and are not investment recommendations. You are responsible for your own investment decisions. Past performance does not guarantee future performance. Opinions are based on historical research and data believed reliable; there is no guarantee results will be profitable. Not responsible for errors or omissions. I may invest in the vehicles mentioned above.