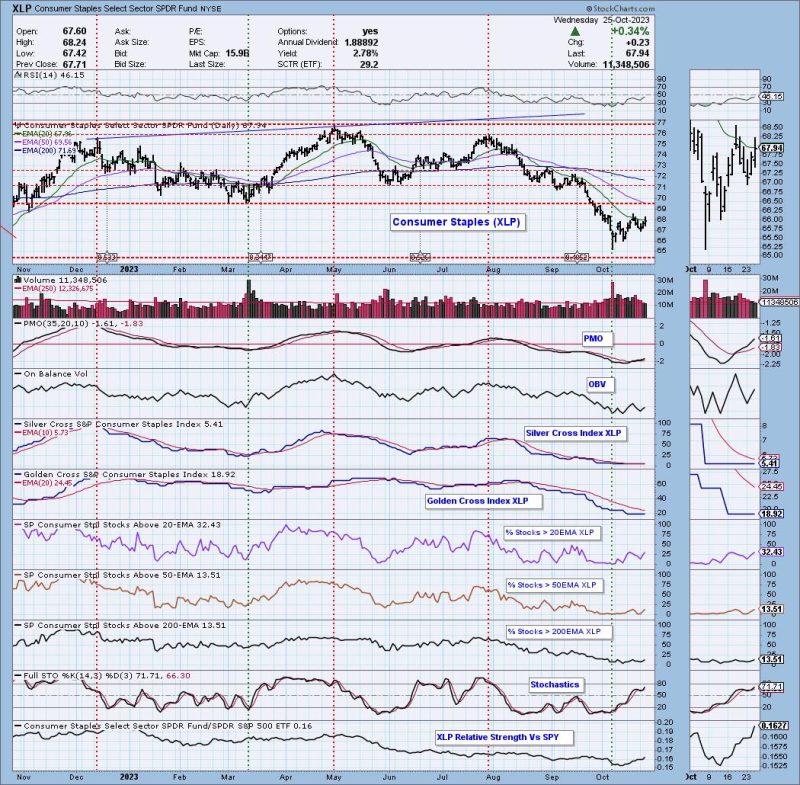

The only two sectors to close higher on Wednesday were in the defensive category, Consumer Staples (XLP) and Utilities (XLU).

We have already been watching XLP as it has established a short-term rising trend. What we aren’t seeing is healthy participation…yet. We are seeing some expansion in stocks above their 20/50-day EMAs, but the Silver Cross Index is stagnant and below its signal line. Still, we do see this as one bright spot to consider in the current market environment if you want to be long.

XLU is experiencing a fresh bounce after losing ground out of the October top. In contrast, we have healthier participation as far as %Stocks > 20EMA. Yet, the Silver Cross Index hasn’t budged. This new rally did put price back above the 20-day EMA and we see a PMO Surge above the signal line (bottom above the signal line). We like XLU’s chances of continuing its current rally.

Conclusion: When defensive sectors lead the market it is bearish overall or could get worse. Seeing these two sectors as bullish should give us pause.

Learn more about DecisionPoint.com:

Watch the latest episode of DecisionPoint on StockCharts TV’s YouTube channel here!

Try us out for two weeks with a trial subscription!

Use coupon code: DPTRIAL2 at checkout!

Technical Analysis is a windsock, not a crystal ball. –Carl Swenlin

(c) Copyright 2023 DecisionPoint.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)