SPX Monitoring Purposes: Short SPX on 9/1/23 at 4515.77; cover short 9/5/23 at 4496.83 = gain .43%.

Gain since 12/20/22: 15.93%.

Monitoring Purposes GOLD: Long GDX on 10/9/20 at 40.78.

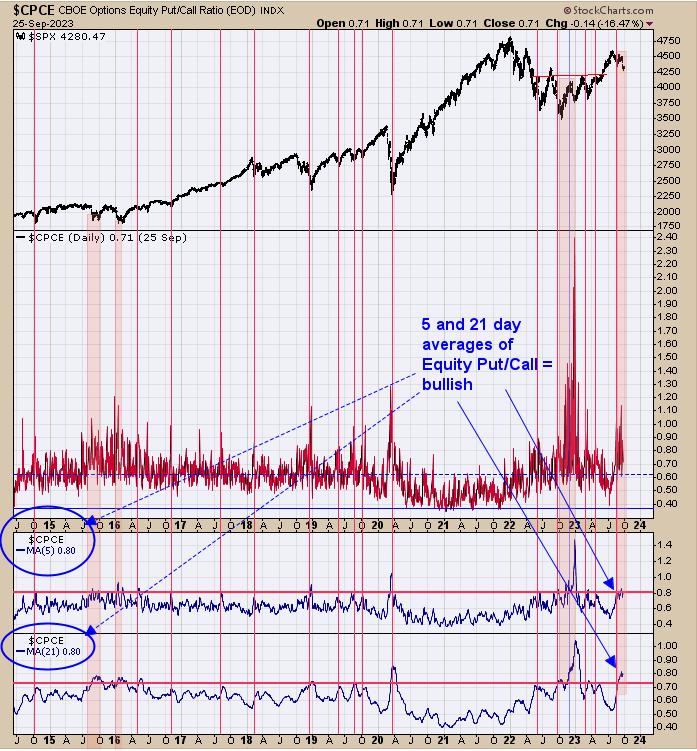

The bottom window is the 21-day average of the CBOE equity put/call ratio, and the next window higher is the 5-day average. We identified the times when both indicators reached bullish levels with red- and pink-shaded areas. As you can see, both are in bullish levels, suggesting a market low is not far off.

The bottom window is the 5-day average of the TRIN and the next higher window is the 10-day TRIN. We shaded in light pink the times when the 10-day TRIN closed above 1.20 and the 5-day TRIN closed above 1.50 and extended the shaded area to the SPY prices. A 10-day TRIN above 1.20 and a 5-day TRIN above 1.50 are normally found near lows in the market. As you can see, both 5- and 10-day TRIN have not reached panic levels (note with red box). Another day or two of declines like today could push both TRIN moving averages to the bullish levels.

We updated this chart from last Thursday, which is the Bullish percent index for the Gold Miners index/GDX ratio. Last Thursday’s chart took this ratio back to mid-2016; the above chart goes back to 2009. The top window is the 28-period RSI, and the next window down is the Bullish Percent index for the Gold Minders index/GDX ratio. A bottom is in for GDX when the RSI of this ratio trades below 30 and than closes above 30. The blue and red lines on the chart above are previous signals. There were 18 signals generated with two failures (noted with red lines), which works out to a 89% success rate. We could see a “back and forth” period, but the chart above has a 89% success rate.

Tim Ord,

Editor

www.ord-oracle.com. Book release “The Secret Science of Price and Volume” by Timothy Ord, buy at www.Amazon.com.

Signals are provided as general information only and are not investment recommendations. You are responsible for your own investment decisions. Past performance does not guarantee future performance. Opinions are based on historical research and data believed reliable; there is no guarantee results will be profitable. Not responsible for errors or omissions. I may invest in the vehicles mentioned above.