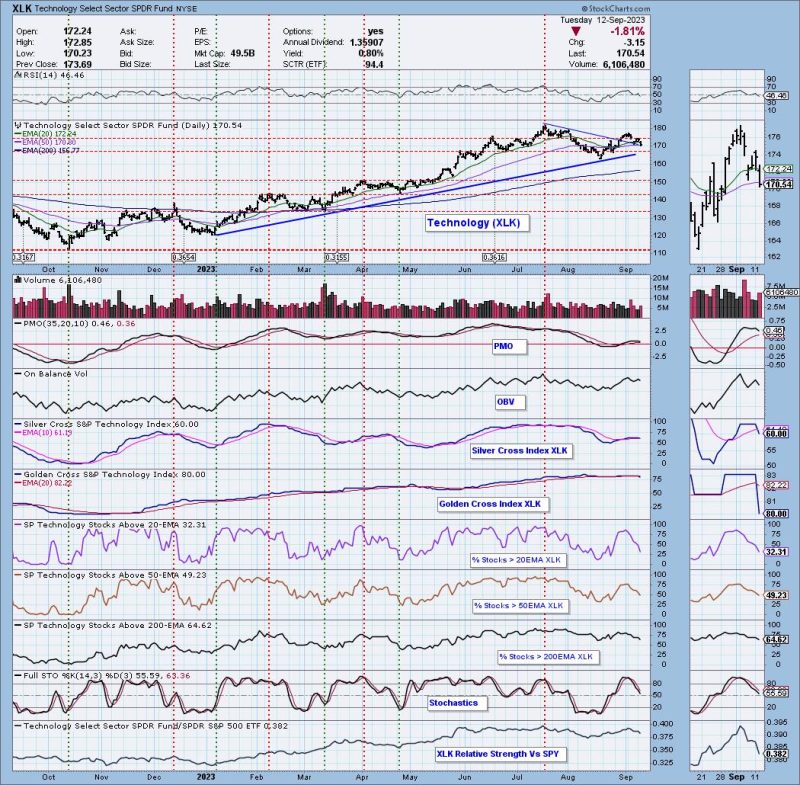

In Monday’s DecisionPoint Trading Room we discussed that Technology (XLK) was the last one standing on our Bias Scoreboard with a Bullish Bias in both the intermediate term and long term. Today that bullish bias was lost in both timeframes. When the Silver Cross Index drops below its signal line, it is a “Bearish Shift” that moves the IT Bias to “Bearish”. When the Golden Cross Index drops below its signal line, it moves the LT Bias to “Bearish” on a Bearish Shift.

The Price Momentum Oscillator (PMO) is in decline again and is headed for a Crossover SELL Signal. Most concerning is the complete loss of participation. %Stocks > 20/50/200EMAs have seen declines since the sector topped at the beginning of September. We would easily read the ST Bias as “Bearish” given %Stocks > 20/50EMAs are below our bullish 50% threshold.

Adding insult to injury are the RSI dipping below net neutral (50) and Stochastics which are falling fast.

Conclusion: Technology tends to lead the market and in this case it should lead the market lower. Indicators are falling with the PMO nearing a SELL Signal. Relative strength has been failing and the loss of the Bullish Bias in both the IT and LT suggest this is not a sector to rely on in your portfolio.

Learn more about DecisionPoint.com:

Watch the latest episode of DecisionPoint on StockCharts TV’s YouTube channel here!

Try us out for two weeks with a trial subscription!

Use coupon code: DPTRIAL2 at checkout!

Technical Analysis is a windsock, not a crystal ball. –Carl Swenlin

(c) Copyright 2023 DecisionPoint.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)