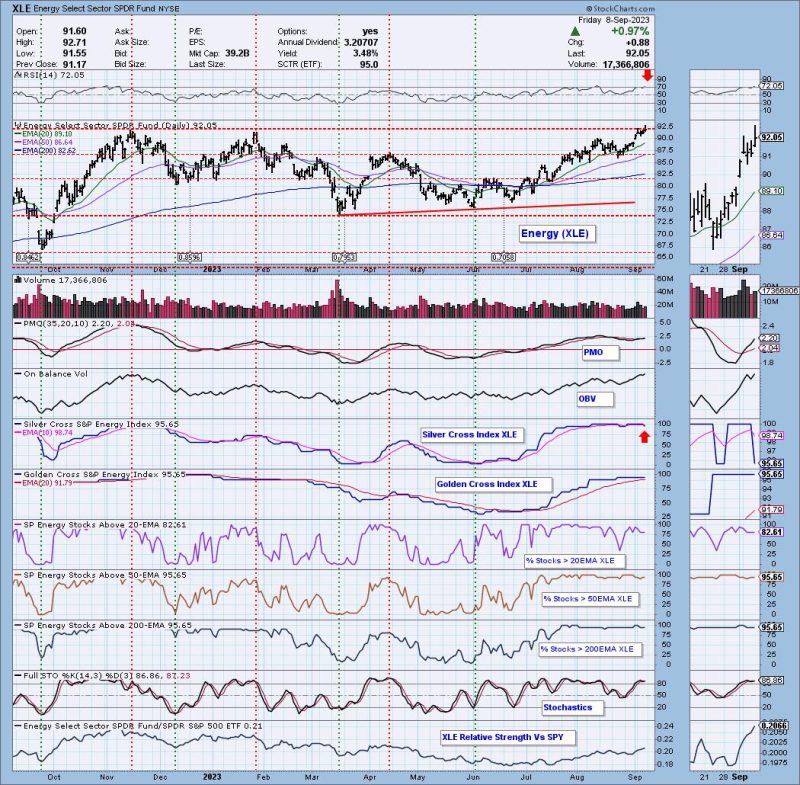

The Energy sector (XLE) has been enjoying a rally throughout the summer. Today it logged a new all-time high on a small breakout. While the sector looks impervious, there are a few concerns that we should point out. First would be the overbought RSI. While a stock’s price can remain overbought, typically when the RSI reaches this level you will see at least a pause. The other issue is the “Bearish Shift” of the Silver Cross Index (SCI) as it crossed below its signal line. The rest of the indicators, including our primary Price Momentum Oscillator (PMO) are bullish. You’ll notice that participation (%Stocks > 20/50/200EMAs) remains well above our bullish 50% threshold and really isn’t bleeding off much. Stochastics are comfortably above 80 suggesting internal strength.

Conclusion: The Energy sector looks very strong, but we are noticing a few problems under the surface. We should remember that overbought conditions can persist in a bull market which XLE clearly is in. If the Silver Cross Index continues to lose ground, we would tighten stops on your Energy positions.

If you’d like to be notified when major indexes, sectors and select industry groups see “Bullish/Bearish Shifts” and given the bias in the intermediate and long terms? You’ll find it in every DP Alert report!

Good Luck & Good Trading,

Erin Swenlin

Learn more about DecisionPoint.com:

Watch the latest episode of DecisionPoint on StockCharts TV’s YouTube channel here!

Try us out for two weeks with a trial subscription!

Use coupon code: DPTRIAL2 at checkout!

Technical Analysis is a windsock, not a crystal ball. –Carl Swenlin

(c) Copyright 2023 DecisionPoint.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)