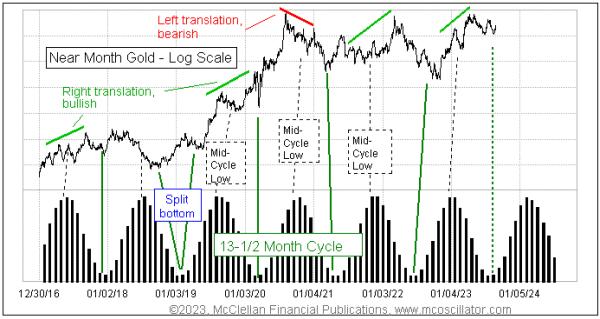

Some analysts talk about seasonality in gold prices, but this does not make sense because of a very important factor. Gold prices have a dominant 13.5-month cycle, not an annual cycle, and so looking at annual seasonality does not make for reliable projections.

This 13.5-month cycle was due for its major cycle low in July to August 2023. I always speak of its due dates in extremely approximate terms, because gold’s actual bottoms can arrive a month or two early or late versus the ideal, while still be considered as arriving normally. And more than once in history, the cycle bottom has seen gold prices split their bottom into two separate ones, each equidistant before and after the ideal cycle low date. In other words, the existence of the 13.5-month cycle is not a great timing tool for identifying the moment of the bottom in gold prices.

That does not mean it is without value, though, because gold’s interaction with this cycle has a lot more to tell us. When a major cycle low in gold prices can be identified as having arrived, as appears to be the case now, the first few months of the new 13.5-month cycle are a reliably bullish time for gold prices. That is what we are facing over the next few months.

This cycle also sees a less important mid-cycle low about halfway between the major cycle lows. So, as the peak of the sine wave representation is approaching, it becomes an environment wherein it is better to be a “trader” for a while than an “investor”. Additionally, the arrangement of prices before and after that mid-cycle low has important information to tell us about what is coming next.

“Left translation” occurs when the price high before the mid-cycle low is higher than the prices after it. That is a bearish configuration, and it says that troubles will persist even after the next major cycle price low. The opposite condition, “right translation”, shows a pattern of a higher high after the mid-cycle low. That is the condition we just saw on the last full cycle, and even though it does not excuse the need for prices to dip in honor of the major cycle low, it does carry a soft promise of good things to come on the next cycle, which is what should be just starting now.

It is hard to imagine gold prices doing well in an environment of high short-term interest rates, especially high “real” rates, meaning that short term T-Bill rates are above the inflation rate. That is not usually a recipe for gold doing well. The counterpoint to that, though, is that everyone knows about this already, and gold investors may be overly discounting it. The Fed raising short-term rates did not stop gold prices from going up during the last cycle’s bullish phase.