SPX Monitoring Purposes: Neutral.

Gain since 12/20/22: 15.50%

Monitoring Purposes GOLD: Long GDX on 10/9/20 at 40.78.

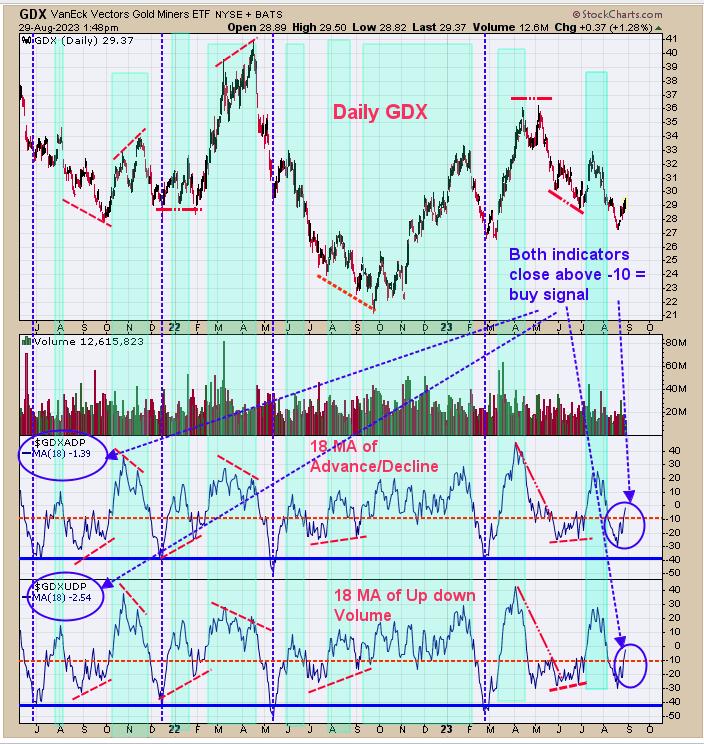

Yesterday, we said, “the light blue-shaded areas are when the 18-day averages for up down volume percent and advance/decline percent for GDX are above -10. When both indicators are above -10, GDX is in an uptrend. Currently, the 18-day average for the up down volume stands at -11.33 (almost there) and the 18-day average Advance/Decline percent stands at -9.33 (bullish). For buy signals, both indicators need to be above -10 and stay above -10 for the buy signal to continue. Unless something weird happens, it looks as though a rally phase in GDX is about to begin.” Today, the up down volume indicator trades at -2.54 (bottom window) and the advance/decline indictor trades -1.39; both above -10 and bullish. As long as both indicators hold above -10, the uptrend in GDX should continue.

Join me on TFNN.com Tuesday 3:30 Eastern Time and Thursday 3:20 Eastern Time.

Tim Ord,

Editor

www.ord-oracle.com. Book release “The Secret Science of Price and Volume” by Timothy Ord, buy at www.Amazon.com.

Signals are provided as general information only and are not investment recommendations. You are responsible for your own investment decisions. Past performance does not guarantee future performance. Opinions are based on historical research and data believed reliable; there is no guarantee results will be profitable. Not responsible for errors or omissions. I may invest in the vehicles mentioned above.