The latest data just out on the monetary aggregate known as M2 showed a continued shrinkage of the money supply. M2, in nominal terms, is now down 3.7% from a year ago. But, at the same time, nominal GDP (not adjusted for inflation) for Q2 of 2023 is up 6.3% from Q2 of 2022. That means the larger size of the economy is having to get by with less money circulating around to keep everything lubricated.

Money supply is like oil in an engine. You need a certain amount to keep everything coated with oil and lubricated. It only takes a small amount of oil to keep the valves and pistons moving, but you need a specific level in the sump for the pump to pick up and circulate everywhere. When that oil level drops a little bit on the dipstick, the engine can still be okay, but if it drops too much, then components will start to fail.

If you put too much oil into an engine, you can harm the engine that way too, making it not work properly. But if you put too much money into an economy, you get some weird effects. One is inflation, the rate of which is coming down as money supply shrinks. Another effect is that stock prices tend to benefit from all of that excess money that does not have a real mission to work on, so that excess money pushes up stock prices.

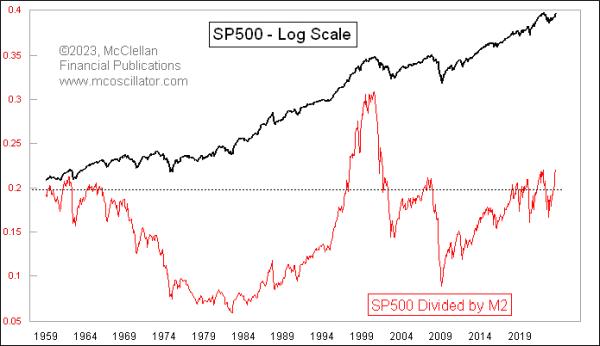

What we face now is a situation wherein money supply is shrinking, but stock prices were still rising as of July. And as we see in this week’s chart, that combination has been pushing up the ratio of the S&P 500 Index level to M2. This is a very high level historically speaking. It did go higher in the late 1990s thanks to the Internet bubble, with predictably painful effects afterward. All of the other instances of this ratio being up this high have also led (eventually) to bear markets.

Shrinking the money supply is arguably a good idea if the problem that you are trying to solve is high inflation. So kudos to the Fed for making that happen. But as an individual investor, we cannot do anything about inflation, and our concern is knowing what stock prices are going to do. This M2 shrinkage is not bullish news for stock prices, although it may not have to take effect immediately. It is possible, as we saw in the late 1990s, for this ratio to continue a lot higher before it decides to matter.