ETF investors who are interested in gold have long been able to turn to products like GLD and IAU as ways to invest in gold. Those ETFs buy and sell gold as needed to back the shares of the ETFs, and the amount of their holdings vary with investor demand, which keeps the share price of those ETFs pretty close to their net asset value (NAV).

A much older product, which is still around, is the Sprott Physical Gold and Silver Trust (CEF), which holds the CEF symbol because it was formerly known as the Central Fund of Canada. A different company, Sprott Asset Management, took over the Central Fund of Canada in January 2018.

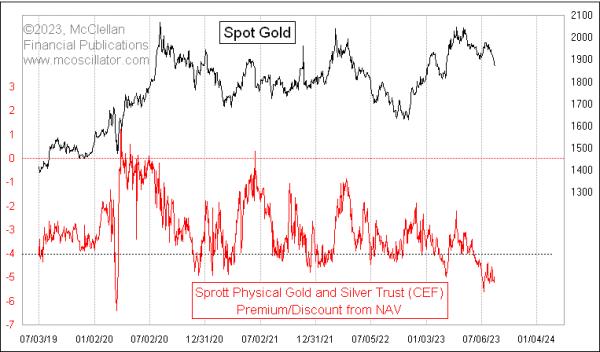

According to Sprott’s web site, “Sprott Physical Bullion Trust unitholders have the right to redeem for physical metals on a monthly basis, subject to meeting the minimum redemption amount.” So unlike an ETF, whose numbers of shares can expand and contract as needed to meet shifting investor demand, CEF’s assets stay relatively fixed over time, and its shares can trade at a premium or a discount to the NAV. Most of the time, the share price is at a discount to NAV.

Sometimes the amount of that discount gets to an extreme level, as investors form such a pessimistic view of the prospects for precious metal prices that they want to get out urgently, and will even accept a price that is at a steep discount to NAV just to be able to exit. We are seeing one of those conditions right now, with CEF shares priced 5% below NAV.

Such instances are reliably associated with important bottoms for gold prices. However, I need to stress that “associated with” does not necessarily mean that the final price bottom is upon us. An oversold “condition” is not the same thing as a “signal”.

The CEF trust holds both gold and silver. Sprott also operates a separate trust under the symbol PHYS, which holds only gold.

Like CEF, the share price of PHYS also trades are a premium or discount to NAV. Right now, the amount of discount in the shares of PHYS is not as large as that of CEF, which is curious. But it is still a pretty sizable discount to NAV, which eventually ought to matter for gold prices.