I always refer to monthly options expiration week as “Opposite George” week. It’s a reference to the Seinfeld episode where George Costanza is, as always, down on his luck. Jerry and Elaine suggest that if everything he does in his life is wrong, then why not just do the opposite of every urge he has. That should then make his life so much better. George actually starts doing the opposite of his instincts and his life immediately turns. Anyhow, this same logic seems to apply to stock market performance heading into options expiration week. There’s typically market maker incentive to send prices lower in certain areas of the market after a big advance, especially if these areas are heavily traded in options. Suddenly, stocks that have been rising have a lot of net in-the-money call premium (which market makers will be required to pay out) and can reverse as options expiration approaches. This weakness generally lasts into the week AFTER options-expiration Friday, but I’ll save that discussion for another day.

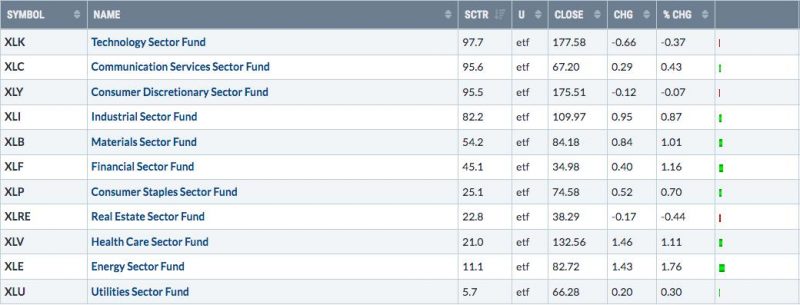

Check out today’s sector performance as of 11am ET:

I sorted it in SCTR order, highest SCTR score to lowest SCTR score. Notice today’s morning weakness is mostly concentrated in top-performing sectors, while strength is focused on the recently-weaker sectors. I discuss and write about this often and it’s associated with monthly options expiration. While we’ve seen a bit of a change in this rotation over the past couple hours, don’t be surprised if you see a return to Opposite George week in full force very soon.

We see the max pain effect on our major indices as well. The QQQ and SPY have both been moving up nicely, but currently have net in-the-money call premium of $1.86 billion and $2.47 billion, respectively. That’s a lot of money on the table for market makers. The point at which market makers would pay the LEAST amount of net option premium, which I refer to as max pain, would be at 355 and 427 for the QQQ and SPY, respectively, resulting in possible declines of 7.61% and 5.75%, respectively. I’m not saying we’ll see that kind of drop, but it’s definitely possible that we’ll soon see a reversal and at least head in that direction. It’s just one reason to be very careful the balance of this week into early next week.

Here’s a chart of the S&P 500, but check out several periods around options expiration and the reversals:

The black arrows mark short-term tops during options expiration week and then a week or so later. They also sometimes mark short-term bottoms during options expiration week and then a week or so later. The red 1’s coincide with key market tops or bottoms during options expiration week, showing the 5-day rate of change (ROC). The 2’s highlight that same 5-day ROC a week or so later. It’s easy to see why I refer to options expiration week as “Opposite George” week.

If we keep moving higher, the odds of Opposite George week and a big reversal grow. Just keep this in mind.

Later today, at 5:30pm ET, I’ll be hosting our monthly Max Pain webinar for July. It’s a member-only event, but there are two ways to attend. First, you can start a 30-day trial to our full service at NO CHARGE by CLICKING HERE. Or, if you’re only interested in our Max Pain service, we’ve made it truly affordable at just $27 per month. If you prefer this option, start your monthly service HERE. Either way, I hope to see you in a few hours!

Happy trading!

Tom