As inflation continues to slow, shoppers are finally getting some relief at the grocery store.

Rising food prices have been among the biggest drivers of inflation since 2020, with a combination of labor shortages, supply chain snags and bird flu outbreaks sending grocery bills rapidly higher.

An NBC News analysis of Bureau of Labor Statistics data shows U.S. consumers are paying nearly 40% more for a basket of common grocery items — including eggs, chicken, milk and coffee — than they did before the World Health Organization declared Covid-19 a pandemic in early 2020.

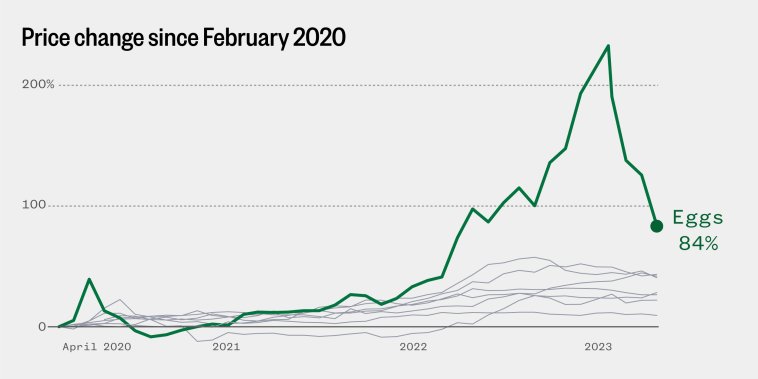

A big part of the grocery price jump came from eggs, which were in short supply for much of the past year due to the worst outbreak of avian influenza on record.

More than 40 million egg-laying hens were culled from February 2022 to January, sending prices up more than 200%. While egg prices are still more elevated than many other grocery items, the problem has improved considerably this year.

Chicken breasts, by contrast, saw much more modest increases. Poultry birds are typically kept separate from egg hens and are slaughtered much sooner after hatching, leaving less time for diseases to spread.

The sharp rise in grocery prices over the last few years has sometimes challenged the conventional wisdom that it’s cheaper to eat meals at home than out at restaurants. While the prices consumers actually pay depend on where they choose to shop and dine out, BLS data shows prices for food at home rose faster than food away from home for most of 2022.

Even so, food away from home is still up more steeply, rising 7.7% since June 2022 versus 4.7% for food at home over that period, the latest data show.

Food inflation is still running hotter than the overall inflation rate. The BLS’s food index was up 5.7% last month from the same time last year — steeper than the national inflation rate of 3%.