The markets pulled back this week amid global recession fears that followed the Bank of England’s interest rate hike. Most concerning to investors was that the ½% increase came on the heels of an elevated U.K. inflation report for May. Thoughts that the U.S. may get stuck in a similar position pushed the S&P 500 lower as rising interest rates are negative — particularly for Growth stocks.

Other factors were at play in last week’s pullback as well, however, with the broader market Indices exhibiting an overbought condition after five weeks of gains. Most stretched were Technology stocks, which were the top performers and were led by Semiconductor and Software stocks.

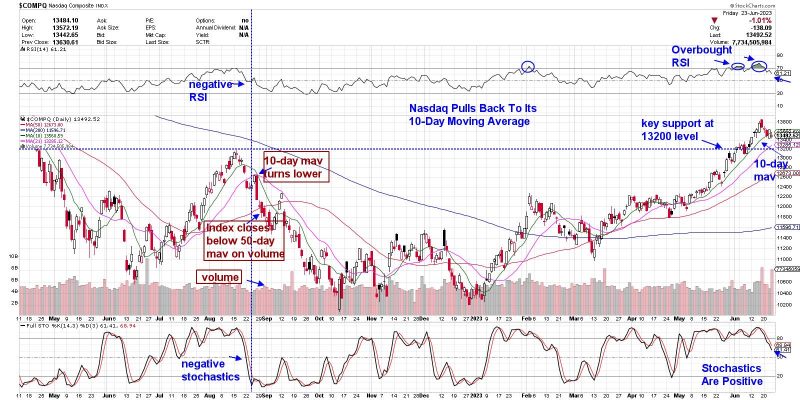

Daily Chart of the Nasdaq Composite

Above is a chart of the Tech-heavy Nasdaq, which has gained almost 17% since March. Gains this month pushed the RSI into an overbought position, with an early June period of consolidation being enough to appease the markets. The more recent overbought condition has brought a pullback into play, with heavy volume on two of this week’s down days, which indicates distribution.

At this juncture, each of the moving averages remain in an uptrend, with the markets exhibiting surprising resiliency in the face of renewed global recession fears. In fact, most of the names from the Suggested Holdings List of my MEM Edge Report outperformed the markets and are holding up above key support.

On the Nasdaq chart above, I’ve highlighted the characteristics of this Index prior to last year’s late August-into-October decline, which resulted in a loss of over 20%. While I’m not anticipating a decline of that magnitude, it’s important to be aware of what to be on the lookout for to signal more than just a 5% pullback.

These signals can be used for individual stock holdings as well. At this time, I’m focused on names in leadership areas that are holding in better than the markets. These stocks will go on to be your top performers once the market pressures are lifted.

Paying attention to any sector rotation will also be key. Last week, we saw a larger pullback in the Industrial and Material sectors, which are cyclical and will be more sensitive to fears of a global recession. The pullback in these areas, as well as Technology, pushed the Equal Weighted S&P 500 down 2.3% for the week. A lessening of participation in the markets would not be a positive.

If you’d like to be alerted to any shift in my outlook for the broader markets, as well as become tuned in to the leadership stocks that will take the markets higher as downside pressure subsides, use this link here to trial my twice-weekly MEM Edge Report for a nominal fee.

Warmly,

Mary Ellen McGonagle, MEM Investment Research