Those who read our Daily and follow us on the media know that we talk a lot about risk gauges. The big focus for me personally is the relationship between the S&P 500 and the long bonds. The other 2 I watch are the relationships between junk and long bonds, and the S&P 500 and gold. All have flashed risk on for some time.

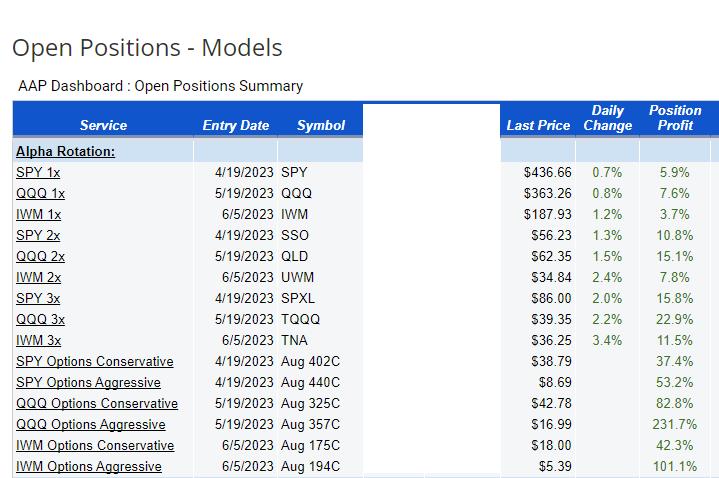

Our Alpha Rotation quantitative strategy that MarketGauge developed uses a combination of market internals, proprietary risk gauges, and market phases to determine risk-on or risk-off. If the math is aligned, we allocate to the major indices, U.S. treasures or cash. We then use both non-leveraged and leveraged versions for our entries. Furthermore, the model is built with initial risk parameters and profit targets. All automated.

The point of my showing you this today is to show you how the “math” has been smart. And the rally has been technical.

While the fundamental number crunching analysts hate this rally, the technical traders and retail investors have had a party. Hence, should the risk gauges change, it stands to reason the now trailing stops will be hit. It also stands to reason that the long bonds will show us the way.

On Wednesday, after the FOMC we said, “We love to watch the Long Bonds as they are a key factor in our risk gauges that help us see risk on/off.” We asked, “What might the Long Bonds be telling us?”

The chart is fascinating.

TLTs ran right up to 2 major moving averages, the 50-DMA (blue) and the 200-DMA (green). The Real Motion Indicator is now a bullish divergence pattern as the red dots cleared the 50-DMA. All the while, the indices enjoyed the rally that continued Thursday-although small caps were dragged along more for the ride.

Keep your eyes on the long bonds. Should TLTs clear and confirm over the moving averages, we might see a shift in the risk gauges. However, to see a shift in risk, the S&P 500 would also have to either stop rallying and consolidate or begin to drop from current levels.

Of course, if the TLTs head lower and the S&P remains strong, risk on until further notice. And we are documenting all of this so you can know what to look at and what to prepare for.

For more detailed trading information about our blended models, tools and trader education courses, contact Rob Quinn, our Chief Strategy Consultant, to learn more.

“I grew my money tree and so can you!” – Mish Schneider

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth and a special bonus here.

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

For more detailed trading information about our blended models, tools and trader education courses, contact Rob Quinn, our Chief Strategy Consultant, to learn more.

“I grew my money tree and so can you!” – Mish Schneider

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth and a special bonus here.

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Mish in the Media

Ahead of the Fed’s announcement, Mish shares her take on major currency pairs, starting with EUR/USD, in this appearance on CMC Markets.

Mish joins Ash Bennington to discuss the market’s response to today’s inflation data, the AI-powered tech rally, whether we’re seeing signs of exhaustion in equities ahead of the Fed announcement on Real Vision.

Mish explains how the Russell 2000 is the canary in a coal mine on Business First AM.

Mish offers her technical forecasts for gold, EUR/USD, USD/JPY and WTI Crude Oil ahead of today’s CPI report on CMC Markets.

Mish Schneider and TG Watkins continue their chat about the business of trading in this video from StockCharts TV. Topics range from their work/home life balance, how being a consumer does or does not play into their trading decisions, and what they do in their free time to unwind.

Mish and Nicole Petallides go over rates, key sectors and the economy in this video from TD Ameritrade. They also discuss what raw materials are coming into vogue.

Mish and Jon talk about what could make markets continue or reverse and what to buy right now on BNN Bloomberg’s Opening Bell.

Mish and Charles talk inflation fears, the “wall of worry” and trading large-caps on Fox Business’ Making Money with Charles Payne.

The first 5 months of 2023 have been rallying on optimism going forward. Will that continue for the next few months? Mish digs into that question in this Twitter Spaces conversation with Wolf Financial.

Mish discusses impacts of weather, labor market and the FED on tap on Fox Business’ Coast to Coast with Neil Cavuto.

The US dollar rallied following a positive US jobs report last Friday, but could the Federal Reserve’s upcoming interest rate decision halt the greenback’s rise? Mish offers her views on USD/JPY, the S&P 500, and light crude oil futures on CMC Markets.

Mish talks GME (Gamestop) and more on Business First AM.

Where is the US economy actually heading? Rajeev Suri of Orios discusses this question and what trends suggest with Mish in this video.

Coming Up:

June 16: Mario Nawfal ETSpaces, 8am ET

June 19: Making Money with Charles Payne, Fox Business

June 22: Forex Premarket Show with Dale Pinkert

June 23: Your Daily Five on StockCharts TV

ETF Summary

S&P 500 (SPY): 440 clears-14 month high now-comments on risk in this Daily should help what to look for.Russell 2000 (IWM): 23-month MA 193 still a bit away.Dow (DIA): 34,000 in the Dow now pivotal.Nasdaq (QQQ): 370 target really close.Regional banks (KRE): 42 support, 44 pivotal.Semiconductors (SMH): 150 now major support.Transportation (IYT): 237 area the 23-month moving average-one place that really makes us believe things are better than okay.Biotechnology (IBB): 121-135 range.Retail (XRT): Back over the 200-DMA and again, needs to confirm and end the week above it.

Mish Schneider

MarketGauge.com

Director of Trading Research and Education